top of page

InfoShare360

IRS Announces Excepted Benefit HRA Limit for 2026

On May 1, 2025, the IRS released the inflation-adjusted limit for excepted benefit health reimbursement arrangements (EBHRAs) for plan...

2 min read

State Disability Insurance Laws

01/01/25 State Disability Insurance Laws Disability insurance provides wage replacement benefits for employees who are unable to perform...

1 min read

Health Plan Deductibles and OOPMs - Key Concepts for Employers

Deductibles and out-of-pocket maximums (OOPMs) are important cost-sharing parameters for health plans. A deductible is the amount an...

9 min read

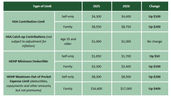

HSA/HDHP Limits Will Increase for 2026

On May 1, 2025, the IRS released Revenue Procedure 2025-19 to provide the inflation-adjusted limits for health savings accounts (HSAs)...

2 min read

Employee Leave – Legal Rules

Employees may need to take time off from work for various reasons, including for their own medical situations or family emergencies....

13 min read

New HIPPA Rule Will Require Updates to Privacy Notices

On April 26, 2024, the U.S. Department of Health and Human Services (HHS) issued a final rule that strengthens the HIPAA Privacy Rule by...

2 min read

DOL Rescinds 2018 Final Rule on Association Health Plans

On April 29, 2024, the U.S. Department of Labor (DOL) released a final rule that rescinds in its entirety a prior 2018 final rule on...

3 min read

ACA Compliance Overview

Summary of Benefits and Coverage The Affordable Care Act (ACA) added a disclosure requirement for group health plans and health insurance...

10 min read

Medicare Part D Changes May Impact Creditable Coverage Status of Employer Plans

The Inflation Reduction Act of 2022 (IRA) includes several cost-reduction provisions affecting Medicare Part D plans, which may impact...

3 min read

CMS Status Update on Advanced Explanation of Benefits Implementation

On April 23, 2024, the Centers for Medicare and Medicaid Services (CMS) provided a status update on the progress it is making toward...

2 min read

Legal Update: California Updates Paid Sick Leave FAQs and Employee Notices

In advance of changes to the state paid sick leave requirement taking effect Jan. 1, 2024, the California Division of Labor Standards...

2 min read

Upcoming ACA Reporting Deadlines

Employers subject to Affordable Care Act (ACA) reporting under Internal Revenue Code Sections 6055 or 6056 should prepare to comply with...

5 min read

FAQs - Final Rule: Employee or Independent Contractor Classification Under the FLSA

On Jan. 9, 2024, the U.S. Department of Labor (DOL) announced a final rule, effective March 11, 2024, revising the Department’s guidance...

13 min read

IRS Announces 2024 Retirement Plan Limits

The Internal Revenue Service (IRS) has released Notice 2023-75, containing cost-of-living adjustments for 2023 that affect amounts...

2 min read

Arizona Announces $14.35 Minimum Wage Rage for 2024

Arizona’s minimum wage rate will increase from $13.85 to $14.35 per hour on Jan. 1, 2024. Arizona’s minimum wage rate is adjusted every...

2 min read

PCORI Fee Amount Adjusted for 2024

The Internal Revenue Service (IRS) has issued Notice 2023-70 to increase the Patient-Centered Outcomes Research Institute (PCORI) fee...

2 min read

Final Forms and Instructions for 2023 ACA Reporting Released

The IRS has released final 2023 forms and instructions for reporting under Internal Revenue Code Sections 6055 and 6056: 2023 Forms...

2 min read

Pay or Play Affordability Percentage Will Decrease for 2024

HIGHLIGHTS The IRS has announced the affordability percentage that will apply under the ACA’s pay or play rules for plan years beginning...

2 min read

Medicare Part D Notices Are Due Before Oct. 15, 2023

Compliance Bulletin Brought to you by: De La Torre & Associates Insurance Services, Inc. Each year, Medicare Part D requires group health...

5 min read

California’s Minimum Wage Rate to Increase on Jan. 1, 2024

Important Dates July 31, 2023 California announced a $16 minimum wage rate for 2024. Jan. 1, 2024 Effective date for the new state...

2 min read

bottom of page