State Disability Insurance Laws

- Jul 7, 2025

- 1 min read

01/01/25

State Disability Insurance Laws

Disability insurance provides wage replacement benefits for employees who are unable to perform their jobs due to non-job-related illnesses or injuries. While most states do not require employers to provide disability insurance coverage for their employees, there are currently five states that require employees to be covered by disability insurance through state-run programs, private insurance, or self-insured arrangements. These states are California, Hawaii, New Jersey, New York, and Rhode Island. Key components of these state programs are as follows:

In each of these states, employers are required to provide coverage for temporary wage replacement benefits for disabled workers.

The duration of benefits, eligibility requirements, and methods for determining the amount of weekly benefits vary from state to state.

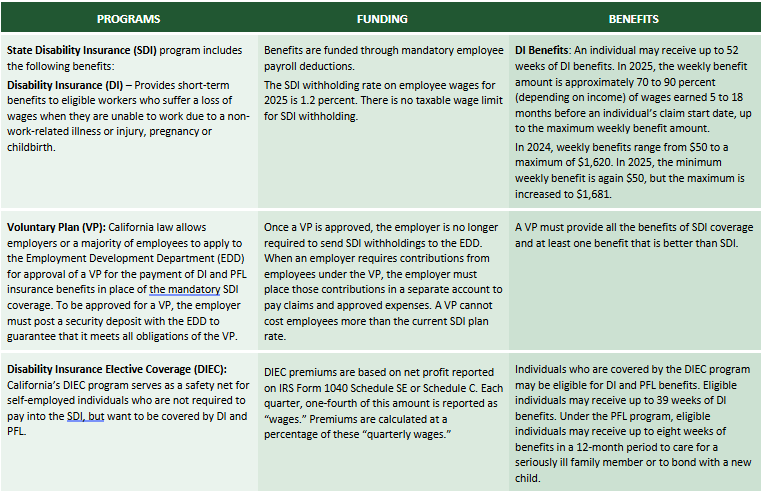

California

Hawaii

New Jersey

New York

Rhode Island

Provided to you by De La Torre & Associates Insurance Services, Inc.

This Compliance Bulletin is not intended to be exhaustive nor should any discussion or opinions be construed as

legal advice. Readers should contact legal counsel for legal advice. @ 2017-2025 Zywave, Inc. All rights

reserved.

Comments